Drug development is exciting. There’s no getting around it: being a part of an industry which aims to improve human health is a great motivator for waking up and heading to work.

Drug development is exciting. There’s no getting around it: being a part of an industry which aims to improve human health is a great motivator for waking up and heading to work.

And for those of us lucky enough to work for a contract manufacturer focused on a diverse range of segments, that feeling of satisfaction is often multiplied when we see the results of what we do having an impact around the world.

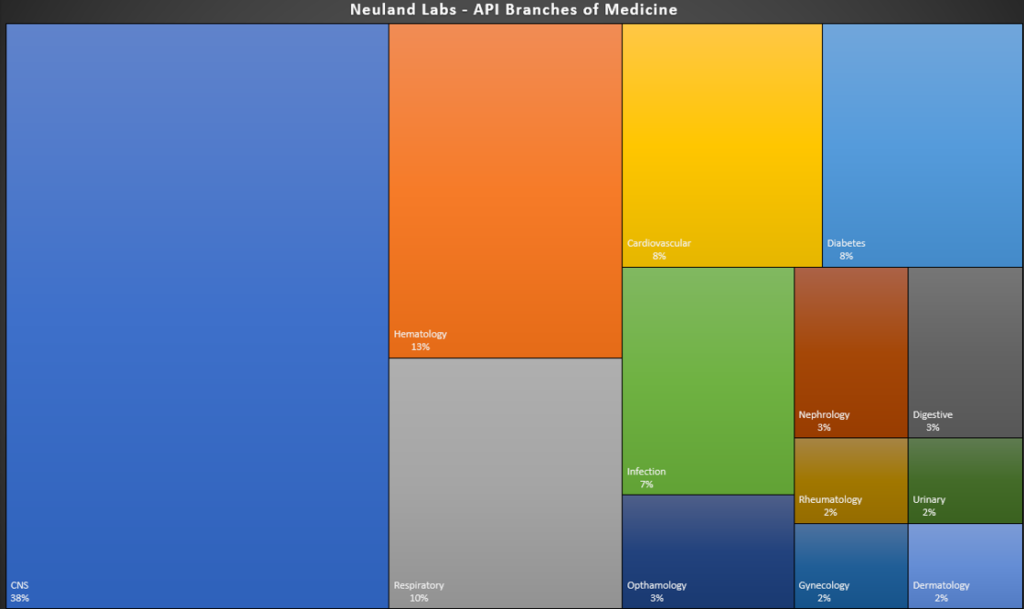

For this post, we’re sharing graphical representations of the therapeutic areas in which Neuland participates. Our APIs cross many therapeutic segments – from CNS and cardiovascular compounds to hematology, respiratory, rheumatology and more.

For our most recent list of APIs, along with a breakdown by stage of development (commercial, validation, development or evaluation) and regulatory status (US DMF, CEP/COS or DMF filed), download our latest Product List (pdf). Note that some of these products are still under patent protection in countries around the world and will only be available for supply after patient expiry.

One noticeable attribute of the graphic above is our ostensible focus on CNS drugs. While we do have a substantial number of CNS compounds among our products, any characterization of our work as CNS-related would be a bit misleading. There are two reasons for this:

1. Neuland actually operates across an incredible diversity of segments, as seen in the graphic above.

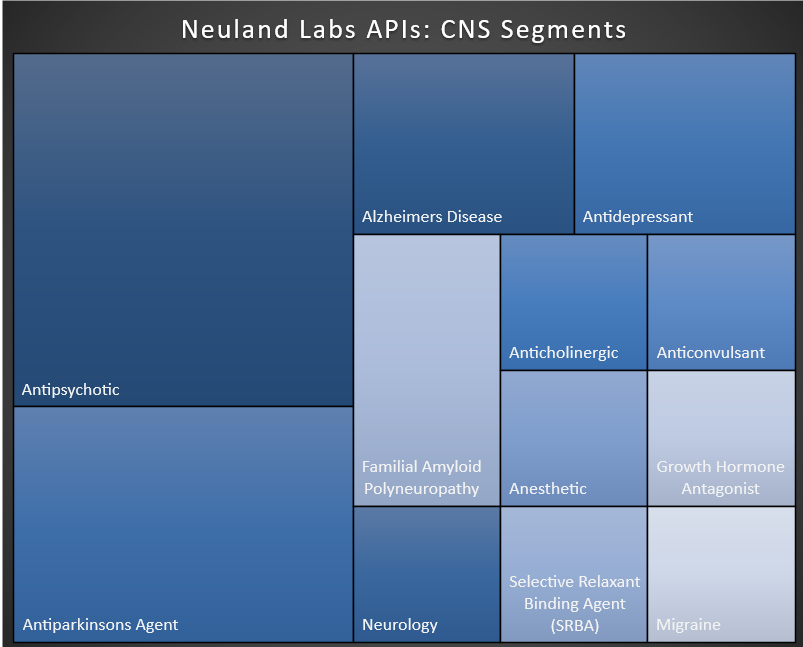

2. Central Nervous System (CNS) therapeutics as a category is exceptionally broad, stretching from analgesics, anesthetics, anti-epileptics and anti-psychotics to drugs for Parkinson’s, MS, cancer, trauma, neurovascular diseases and much more. Within the ‘category’ of CNS, Neuland manufactures APIs for Alzheimer’s, Parkinson’s and migraine as well as antipsychotics, anticholinergics, anticonvulsants, anesthetics, etc. Each of these slivers of the CNS space is practically a market segment unto itself.

That being said, it is important to note that CNS is a huge opportunity. It also happens to be an exceptionally demanding segment for drugmakers. To date, science has gained only a partial understanding of certain CNS conditions, and still must grapple with overcoming the blood-brain barrier – a key hurdle to treatment.

From Advances in Drug Discovery for Central Nervous System Diseases (December 2020):

“Compared to other areas of drug discovery, the clinical failure rate for new drugs targeting the central nervous system (CNS) diseases is even higher. A study from the Tufts Center for the Study of Drug Development found that the success rate for CNS drugs, defined as final marketing approval by the FDA, was less than half the approval rate for non-CNS drugs (6.2 percent versus 13.3 percent) from 1995–2007. Additionally, the mean development time was greater, the time to approval following application submission for marketing approval was longer, and the number of CNS drugs given priority consideration by the FDA was significantly lower relative to non-CNS drugs.”

In 2020, the already-demanding characteristics of CNS development ran headlong into COVID. From A view into the central nervous system disorders market, at nature.com:

“Global sales of prescription and over-the-counter (OTC) central nervous system (CNS) disease-related products totaled $86 billion in 2019. Sales were predicted to grow in 2020, but the field has been one of those hardest hit by the COVID-19 pandemic. The total 2020 forecast fell by $1.4 billion between March and June of 2020, as social distancing and lockdown measures made clinics more difficult to access. But, despite the uncertainties caused by the pandemic, analysts predict that the CNS product market will expand to $101 billion in 2022 and to $131 billion in 2025.”

While drugs to treat CNS disorders face challenges, it is also a segment brimming with tremendous untapped potential. As we continue to improve our understanding of the biology of CNS conditions, novel therapeutic opportunities will emerge.