CDMO Market Outlook 2025–2030: Trends Shaping the Future of Pharma Outsourcing

The Contract Development and Manufacturing Organization (CDMO) industry is poised for dynamic growth on a global scale.

By 2030, the CDMO market is expected to reach nearly $230 billion. What’s driving this acceleration, and how can industry leaders stay ahead?

Pharmaceutical companies are increasingly outsourcing drug development and production to specialized partners.

Let’s explore the outlook for the CDMO market in detail by discussing key growth trends, industry shifts, and investment drivers shaping its trajectory.

Strong Growth Trajectory for the Global CDMO Market

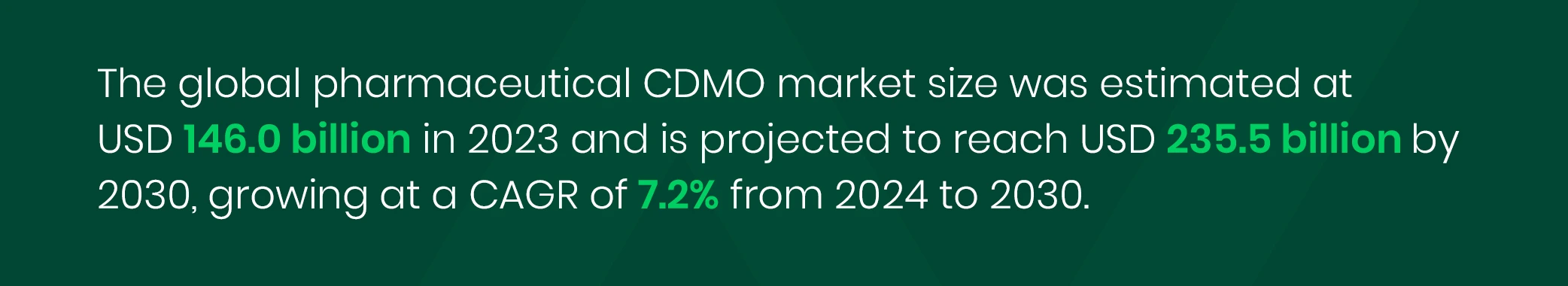

The global CDMO landscape is entering a period of sustained expansion. CDMO market growth forecast indicates significant growth in annual revenues.

A healthy CAGR on the order of 7% from 2024 to 2030 is visible, outpacing many other segments of the pharmaceutical value chain.

Notably, this growth aligns with the broader pharma industry’s expansion. Global prescription drug sales are expected to hit $1.7 trillion by 2030 (about 7.7% annual growth). This underscores the growing role of CDMOs in delivering new therapies to market.

Several factors drive this growth. CDMOs invest heavily to expand capacity, while pharmaceutical and biotech innovators bring new drug candidates and therapies into development, increasing demand for external support.

From a geographic perspective, growth is global:

- The Asia-Pacific region currently leads in CDMO activity, representing about 38% of the market, thanks to its extensive manufacturing capacity in countries like China and India

- North America, meanwhile, is projected to be the fastest-growing regional market for CDMO services through the forecast period, driven by strong R&D pipelines and increased outsourcing of advanced therapy manufacturing in the U.S. and Canada

- Europe also continues to expand CDMO utilization, with notable consolidation in markets like Germany and high growth in the UK

Key Drivers Fueling CDMO Industry Expansion

Here are the top three key drivers that are fueling the rapid expansion of the CDMO industry between 2025 and 2030:

Surge of Small Biotechs and Novel Therapies

The global pipeline of drug candidates is booming, particularly driven by small and mid-sized biotech firms that often lack in-house manufacturing facilities. These innovators rely on CDMOs to advance candidates from the lab to clinic and beyond.

At the same time, many novel therapies and specialty small molecules require highly specialized development and production capabilities that few organizations possess internally.

Cost Efficiency and Focus on Core Competencies

Engaging a pharmaceutical CDMO allows companies to focus on their core competencies while leveraging the economies of scale and process expertise of contract manufacturers.

CDMOs can often manufacture drugs more cost-effectively due to dedicated infrastructure and technical know-how, which helps reduce time-to-market for new therapies.

Pharma outsourcing trends also convert fixed costs into variable costs for pharma firms, improving financial flexibility. These efficiency gains and financial benefits continue to drive outsourcing decisions

Regulatory and Compliance Advantages

Keeping up with GMP standards and regulations is resource-heavy. Outsourcing helps drug sponsors reduce compliance risks and maintain quality without the full regulatory burden.

This is increasingly attractive as quality standards rise globally and as new regulations (for example, serializations, price controls, or technology assessments) add complexity to the manufacturing process.

Trends Shaping the CDMO Market (2025–2030)

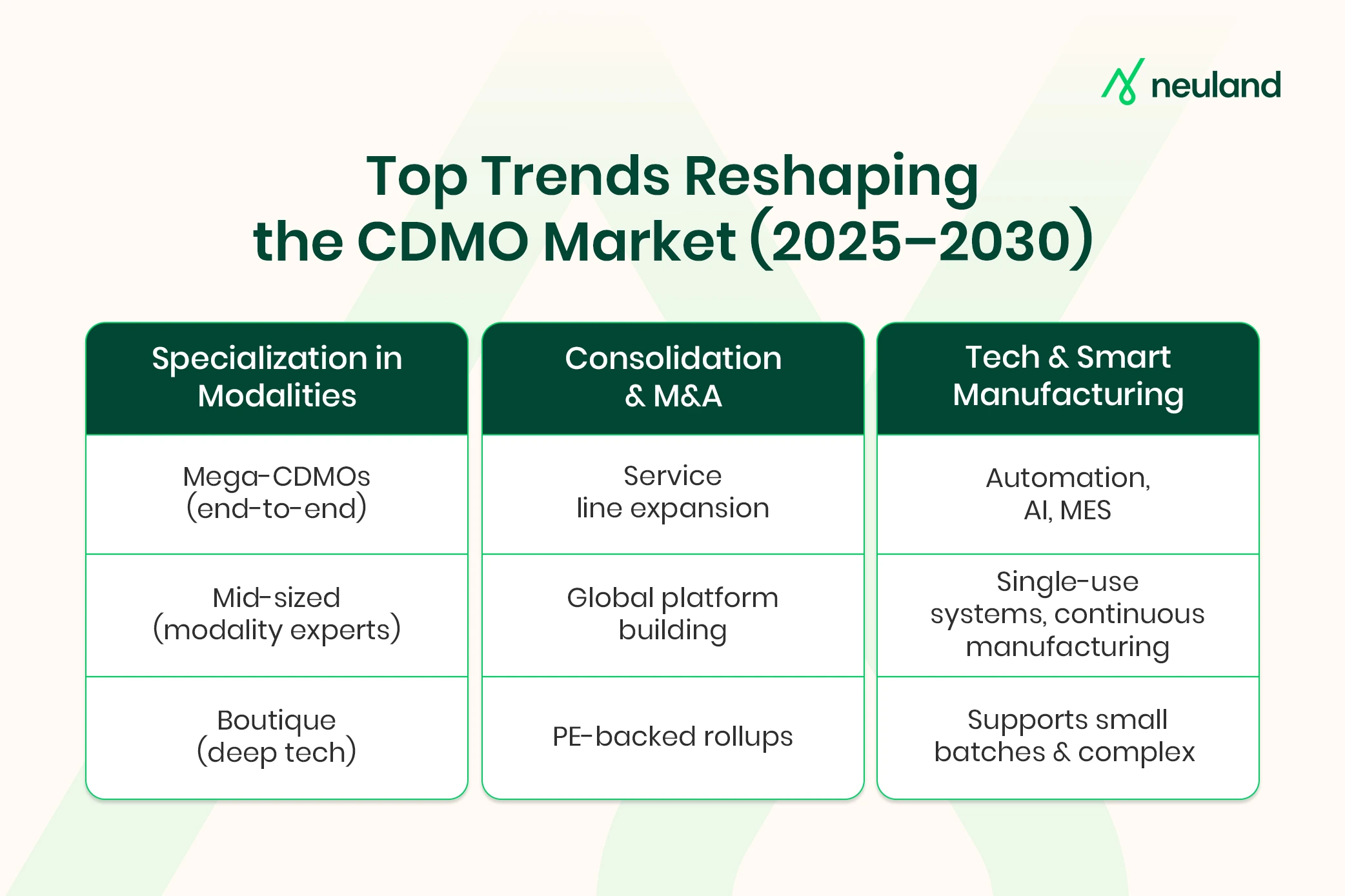

Beyond these drivers, several industry-wide trends are shaping how the CDMO market will evolve toward 2030:

Specialization in Emerging Modalities

There is a countervailing trend of highly specialized CDMOs focusing on particular technologies or therapy modalities.

The emergence of cell and gene therapies, peptides, high-potency APIs, and complex molecules has increased demand for niche expertise. The global CDMO landscape will include mega-CDMOs with broad services, mid-sized firms excelling in specific areas, and boutique specialists.

Consolidation and M&A Activity

The CDMO market is experiencing significant consolidation as larger firms acquire smaller ones to expand their offerings and global reach.

In fact, one analysis predicts that top CDMO companies could collectively command around 40% of the market by 2030. We are already witnessing a wave of mergers, partnerships, and private equity investments aimed at building larger CDMO platforms.

Technology and Innovation in Manufacturing

Automation, robotics, and digitalization are being implemented on production floors to improve yields and reduce downtime. Artificial intelligence and data analytics are increasingly used for process optimization, quality control, and supply chain management.

Continuous manufacturing, single-use bioreactors, and advanced platforms are increasingly used for flexible, cost-effective production. These innovations cut costs and turnaround times, helping CDMOs better handle complex molecules and personalized medicines.

Investment Drivers and Investor Interest in the CDMO Industry

The growth and trends above have not gone unnoticed by the investment community. The CDMO market has become a hotbed of investor interest, thanks to its strong fundamentals and growth prospects:

Stable, Long-Term Demand

The CDMO market continues to grow in step with global pharma R&D, showing ~7% annual growth even during economic downturns. Long-term contracts and multi-year agreements offer CDMOs stable, recurring revenue that appeals to risk-averse investors.

Diversification and Low Correlation

CDMOs serve diverse clients and drug programs, reducing dependency on any single product. This makes the sector attractive to investors seeking lower-risk exposure across the pharma lifecycle, including large firms that form joint ventures to ensure capacity.

Continued Capacity Expansion

Global CDMOs are investing in new facilities across the U.S., Europe, and Asia to meet rising demand. These expansions, often backed by government incentives, signal confidence in future utilization and create strong long-term value for investors.

Future of the CDMO Industry Through 2030

As we look toward 2025–2030, the CDMO industry outlook is overwhelmingly positive. Elevated pharma outsourcing trends, an unprecedented pipeline of new therapies, and the push for efficiency and specialization all point to sustained growth for CDMO providers worldwide.

Neuland Labs, as a global CDMO specializing in small molecules and peptides, exemplifies how CDMO companies can align with these industry trends to thrive. Small-molecule drugs still dominate pharmaceutical therapy—69% of new FDA approvals and about 58% of global sales in 2023—driving demand for advanced chemistry and peptide synthesis services.

Moreover, by investing in state-of-the-art manufacturing facilities and regulatory compliance, Neuland can serve as a reliable partner to pharma companies worldwide looking for both expertise and quality.

Investor confidence in the CDMO market and strong industry fundamentals indicate a promising future, with companies like Neuland Labs playing a key role in future pharmaceutical breakthroughs.

FAQs

|

|

|

|