There’s an eye-popping amount of good news for pharma floating around out there. One report claims a ‘Golden decade of unbelievable innovation’ lies ahead. Others point to COVID19 as the ultimate regulatory process-shortening tool – getting vaccines into arms worldwide in under than year.

There’s an eye-popping amount of good news for pharma floating around out there. One report claims a ‘Golden decade of unbelievable innovation’ lies ahead. Others point to COVID19 as the ultimate regulatory process-shortening tool – getting vaccines into arms worldwide in under than year.

And yes – this has been a year in which expectations seem to have shifted broadly. When the world shut down, it was quickly re-opened in new ways, using new technologies and processes.

But how many of these changes will be lasting? It’s a safe bet regulators still won’t go to such calendar-condensing lengths for a new hair growth therapeutic!

At the same time, things are likely to change, aren’t they? After all, we’ve solved some very large challenges and many of the lessons can still be applied when we return to a semblance of normality.

There are many opinions on the subject.

McKinsey and Co. recently pointed out:

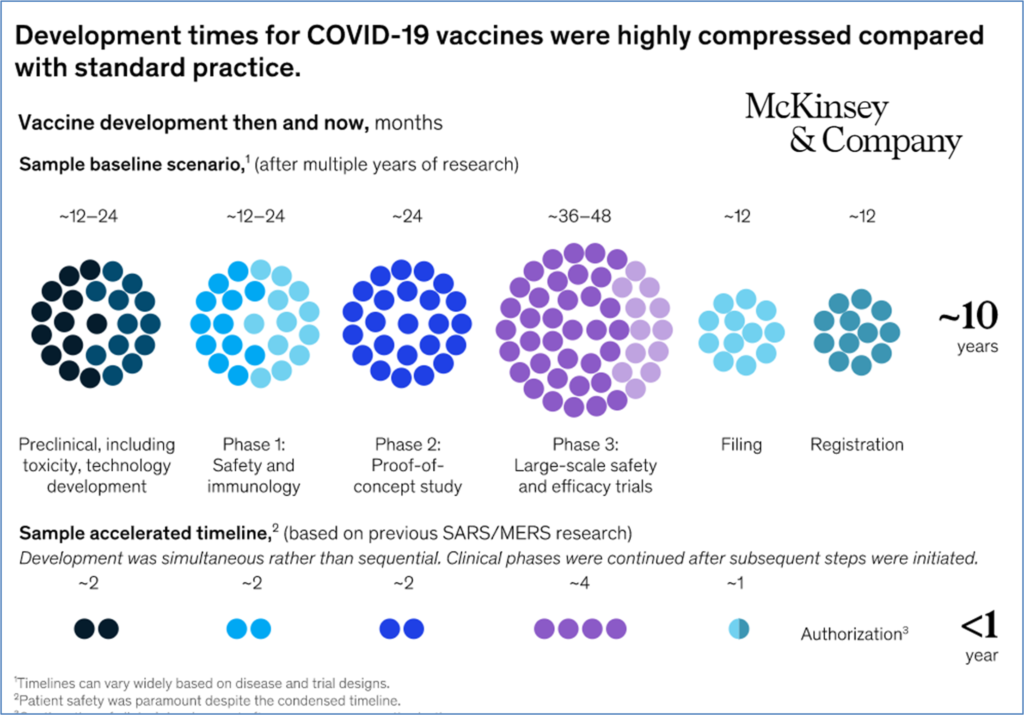

“An analysis of all new drugs developed since 2000 shows that the mean development timeline—from the start of clinical testing (Phase 1) to approval—is nearly ten years. The same holds true for new anti-infective vaccines: the development of vaccines for the human papillomavirus, shingles, and pneumococcal infections, for instance, clocked in at between nine and 13 years. Most academics and pharmaceutical-industry stalwarts would consider a development timeline of less than five years to be highly unusual.”

This is the way things have always been done.

Drugs generally take ten years and X billion dollars to reach market, with some variability over the years. Costs typically rise, and time-to-market holds reasonably steady. It doesn’t change too much.

And then COVID.

McKinsey put together the following graphic demonstrating the difference between ‘then’ and ‘now,’ comparing the compression of the vaccine commercialization timeline with a sample baseline scenario:

But could this be the new path forward, with drug approvals accelerated to the kinds of timelines we’re seeing with the vaccines?

Let’s explore what experts believe will endure and forever change how we operate in the drug discovery, development, commercialization and distribution space.

Regulatory Fast Tracking – the System Worked

Coronavirus vaccine development and distribution demonstrated a functional high-speed ramp up process, made possible due to fast-track regulatory approvals in key geographies and a public-private partnership approach to investment. Speed was the name of the game, especially when it came to investigating the safety and efficacy of countless compounds and treatment protocols.

McKinsey reports that regulators “increased the frequency and intensity of sponsor engagement,” building on the regulatory collaboration model “used by agencies to facilitate alternate pathways in drug and medical-device development over the past decade.”

Examples of such engagement in the past include “the US Food and Drug Administration’s breakthrough therapy designation, fast-track designation program, and the Real-Time Oncology Review pilot. Similarly, the European Medicines Agency created its accelerated-assessment timetable and guidelines, and Japan’s Pharmaceuticals and Medical Devices Agency developed its Sakigake designation program.”

The pandemic’s expedited development will be studied and evaluated, and new programs or processes are likely to emerge that could help accelerate aspects of the approval process.

Unfortunately, according to McKinsey: “Many of the factors that helped compress development timelines for the COVID-19 vaccine were specific to this global pandemic and likely cannot be replicated in all future drug-development programs.

However, McKinsey agrees that there are lessons to be learned from COVID. “There are lessons companies can take from this experience to potentially reduce development timelines by several years, including revamping their design and execution of clinical trials, their approach to risk investment, and their engagement with regulatory agencies.”

Here are two more aspects of drug discovery, development and commercialization which are likely to prevail based on these newer ways of thinking.

Collaboration

Partnering and collaboration have been a dominant business models in the life sciences for decades, and that won’t change. But what has changed in a post-COVID era is the scale and range – as well as the groundswell of projects that have brought competitors together. We are collaborating more and reaching further. The irony isn’t lost on me, as governments and companies work together to improve supply chain resilience by chipping away at the supply chain globalization.

The breadth of collaboration has been stunning. A Wall Street Journal headline captured it perfectly earlier this year in To Make More Covid-19 Vaccines, Rival Drugmakers Team Up. “Sanofi and Novartis are among the big pharmaceutical companies that have agreed to help make a competitor’s shots. Sanofi and GlaxoSmithKline announced a vaccine development partnership in September 2020. More recently, Merck partnered with Johnson & Johnson to manufacture J&J’s one-shot Covid-19 vaccine.”

Collaboration has flourished not only among drug companies, but with the public health sector, academia, governments and NGOs, and more.

The big question is: will we see a longer-term, continuing collaborative trend in the industry? The challenge may be the lens we use to view things post-COVID. The pandemic has dominated news and sucked a lot of oxygen out of the room. For the last 1-1/2 years, it was healthcare. It was bio/pharma, and diagnostics, and food supply chains, and new social rules & practices. Collaboration in the COVID-era was – much like the use of fast track designations – something of a one-off, a perfect convergence of events.

But a newfound sense of collaboration – not just to share and spread risk, but to speed discovery – has taken hold and is likely to reproduce itself at smaller scale in numerous life science silos. Cancer immunotherapy is one such area, as is cell & gene therapy.

Last month, Bioprocess International predicted the Big Pharma collaborative trend would continue beyond COVID. “Manufacturing collaboration between traditional rivals will be normal post-pandemic say GSK and Merck & Co., both of which are using their capacity to support fellow Big Pharma COVID-19 efforts.”

Others have mirrored the same sentiment. From PharmTech, for example: “The rapid and efficient delivery of innovative treatments through the COVID-19 pandemic has demonstrated the value of collaborations within the bio/pharma industry.”

Digital Healthcare

Digital health is one of those areas of drug industry partnership that pre-dated COVID and will continue to expand and play an increasingly important role in healthcare. With what would seem to be prophetic timing, this 2018 article at Xconomy explored how Novartis, Sanofi, AstraZeneca and JNJ were already exploring the nascent field of digital medicine just a few years before it became a global priority.

Digital health is perhaps one area in which it would be difficult to return to the way things were once done.

- A one-on-one with your primary care doctor from the sofa, via tablet?

- Remote clinical trials, allowing more inclusive patient populations?

- Better data, to alleviate unforeseen problems during drug development and manufacturing?

- Remote regulatory inspections, to maintain operations during local or global crises?

We’ve added a number of tools to our toolboxes that would be reckless of us to abandon – for patient health, healthcare practitioners and manufacturers.